Q1 2024: Moving Industry Data

Welcome to the beginning of Moovsoon’s “making moves” series! These moving industry reports will be published bi-quarterly to allow data to be compiled and the lag across resources to catch up. If there are any significant stats/trends/news, Moovsoon will add these as a standalone report.

It’s no longer the all-you-can-eat buffet of business for home service providers. Interest rates are up, home inventory is low, and advertising is expensive. Yet, most home service providers, especially moving companies, are stuck in non-dynamic marketing and trying to earn business with old tricks.

It’s a shame since local data surrounds movers and should allow them an edge for direct marketing and sales strategies. However, moving companies have limited experience leveraging data to adjust for market trends. Whether it’s resistance to a new strategy or an awareness issue, we could do better either way.

In these articles, we’ll glean moving, migration, and housing data from direct sources (NAR, Van Lines, Census) and paint a high-level picture of the industry. Moving companies can use this data, such as Moovsoon’s data team, which uses it to determine what data points can impact marketing and sales strategies.

Let’s dive in!

*Please note a lag in data sourced from official sources. Moovsoon uses a meta-analysis approach to infer trends from previously published reports and datasets (*only heatmaps / owner-occupancy are proprietary to Moovsoon).

Q1 2024 Moving Industry: Takeaways

Anyone in the industry will tell you that 2023 was a challenging year in the moving industry. The interest rate hikes put brakes on the housing market, which, naturally, limits the opportunity for movers. Overall moving trends (total US families moving, distance moved, the reason for moving) match previous years’ numbers.

However, some macro-trends will seemingly impact the industry for the foreseeable future. For one, home inventory and sales will be well below COVID activity. Movers expecting a return to a 2020-2022 housing market may be disappointed. Inflation seems stubborn, and interest rates will likely remain at their current levels. Zooming out could mean continued consolidation of companies in the moving industry and a smaller opportunity pool for local/interstate movers.

The moving industry state may seem precarious, but many industry trends are returning to pre-COVID norms. Also, several real estate shifts will positively impact movers if they recognize and act on them.

Top Q1 2024 Trends for Movers

- Renters are starting to skew younger and more high net worth – movers need to pay attention to this segment

- Regional moves are on the rise – movers need to adjust service and pricing strategies to ensure their business fits this local/long-distance gap

- Seniors (the “silver surge”) will continue to define relocations

The largest trend we see developing is the changing demographics with renters. Renters are only about 33%-35% of the real estate market (compared to home ownership), but more high-income and young families are becoming/staying renters. Rentals are a large part of a mover’s business, as renters move more often. However, movers are not great at proactively capturing this market or changing their service offerings to make these a bigger part of the bottom line.

The second trend is regional moves seem to be trending up. Interstate moving is up, which is not reflected in long-distance moving numbers. It seems families are staying close to metro areas but not entirely moving out of the city’s proximity. See our heat maps below to get a sense of this distance. This distance is a hard price point as it doesn’t yield the same revenue as long-distance moving, but it requires state licensing and full-day crew commitments. Movers should consider looking at their CRMs and IDing their regional traffic lanes. Based on these lanes, rates could vary to make interstate moves higher margin.

The last callout is: don’t ignore the “silver surge!” The outbound/inbound reporting has covered this well over the last decade. People are moving to Texas, Florida, and the Carolinas. A large portion of this migrating population are retirees or soon-to-be retirees. Movers should be creative with partnerships with retirement communities, heavy-traffic lane rates, and engagement opportunities. It doesn’t seem like this trend will be curbed in the next few years.

Moving Industry Stats

- In 2022, 28.2 million people moved to the US. This represents 8.7% of the US population

- 8.2 million people in 2022 moved between states (compared to 7.9 in 2021) (source)

- In 2023, It’s projected that fewer than 8% of Americans Moved, 7.8% of the US population

- This is the lowest moving percentage in recorded history (source)

- About 35% of movers DIY and rent a truck, 25% DIY with no rentals/assistance, 20% hire a full-service moving company, and 15% DIY with a moving container (source)

- **Stats are generalized across datasets – no strong single source of breakdown

- Statistics from AMSA show that 15.3 million American households move annually if taking into account the average household size of 2.3 people

Renters are Evovling

While the renter-to-homeowner split has stayed steady at around 65% vs. 35% in the US, the demographic of renters is changing. What once was seen as a less profitable (and viable) market for movers is quickly changing.

It should be noted that 42% of renters in the U.S. live in single-family rental properties— 45 million US residents. This property type tends to yield better revenue and move opportunities, and movers tend to think renters are mostly apartment-based.

More importantly for the moving industry, renting increased across all age groups over the last decade, but the biggest increase was among older adults. Renting among this age group grew by 32% between 2010 and 2020. This trend was seen mostly in the Sun Belt, with retirees or soon-to-be retirees heading to warmer weather and more affordable housing.

What’s more, number of renter households with incomes of more than $150k has grown by 82% since 2015. This is a strong indicator that renting is no longer a choice for financial reasons but also for preference. This trend seems to be growing, which should incentivize movers to find ways into this market.

Lastly, young families tend to rent more due to the need to save for housing, and most millennials are at the “peak” of their families at the start of their lives. As this generation has kids but is encountering an unfavorable housing market, they’ll likely rent to save for a home while having space to raise a family.

Moving Type: Interstate Up, Long Distance Down

According to U.S. census figures, 18% of moves in 2023 were interstate (moving across state lines). Conversely, the same county moves only accounted for 54% of all moves in 2023—these types used to account for 65%-70% of total moves earlier in the decade.

That said, long-distance moves have dropped as in 2023, the average distance per move was 32 miles. A sharp decline from the 103 average miles moved in 2022. (source)

This data seems to support that families relocated longer distances during COVID to find more space and settle in suburban/secondary city locations. Families seem to be staying near their current metro areas while moving outside the immediate city parameters. This is a trend we’ll continue to monitor.

For movers, this seems to make a business case for being regionally flexible (carrying several state licenses and ensuring a pricing strategy that accommodates mid-distance moves).

Why People are Moving?

The reason for moving has not significantly changed in the last five years. However, there are a few trends to pick out that seem to be shaping relocation motivation in the coming years.

According to the latest U.S. Census Data, housing-related reasons accounted for 41.6% of moves.

Not surprisingly, needing a newer, better, or larger house or apartment was the most common reason cited for moving in 2022 (followed by establishing one’s household). However, the “percentage of movers reporting housing unit upgrades declined.” The U.S. Census data highlights that upgrades (up-sizing, better neighborhoods, etc.) are less of a reason for moving. This reflects the housing market trend or limited inventory and the affordability of homes.

The second most often-cited general reason for moving in 2022 (26.5%) was family-related reasons. These can include changes in marital status and establishing one’s household.

What’s interesting is the increase in moves occurring due to “wanting to be closer to family.” We speculate this is driven by the retirement demographic or remote jobs allowing families the flexibility to be close to family. What seems to be true is that this trend looks to be stable in the next few years.

Also, according to the HireAHelpers Annual Migration study, retirement was the reason for the biggest year-over-year growth. “About 44% more Americans moved to retire in 2023, compared to the year before.”

This signals that the “silver surge” is playing out in the moving space. Over the next decade, this population will greatly influence interstate moving. As noted at the beginning of the article, movers should consider ways to adjust or augment their services to capture this type of move better.

Existing Home Sales: February 2024

(Source)

Home sales and home sale activity is down YoY. This could signal that high-interest rates are still keeping homeowners in place. It seems only critical events are reasons for moving (see moving reason), and homeowners with lower interest rates stay put.

Single-family home sales were down 2.7%, while condominium sales fell 8.9% compared to February 2023.

Compared with February of 2023, inventory levels were up 10.3%. It will take 2.9 months to move the current inventory level at the current sales pace, well below the desired pace of 6 months. Demand is currently outpacing inventory.

It takes approximately 38 days for a home to go from listing to a contract in the current housing market. A year ago, it took 34 days.

2023 Home Search Highlights

(source)

Housing Trends

- 70% of recent buyers did not have a child under 18 in their home.

- This supports the trend that young families are staying put unless there is a strong reason to move

- 79% of sales were of detached single-family homes – the most common home type for mover – followed by townhouses or row houses at 8%.

- Senior-related housing increased this year to 19% from 7% last year (for buyers over 60), with 17% of buyers typically purchasing condos and 12% purchasing a townhouse or row house.

Real Estate Agent Trends

- 89% of buyers recently purchased their home through a real estate agent or broker

- 89% of home sellers worked with a real estate agent to sell their home, 7% sold via FSBO

- Even with the rocky months NAR has experienced in 2023, it seems using a real estate agent is still relevant

- For movers, this indicates that real estate agents are great referral sources for business

Home Seller Trends

- The typical home seller was 60 years old

- For all sellers, the most commonly cited reason for selling their home was the desire to move closer to friends and family (23%), because the home is too small (13%), or a change in the family situation such as marriage, divorce, or new child (10%)

- 39% of sellers traded up to a larger home, and 33% purchased a smaller home

- Traditionally, this data point is skewed for larger home purchases. This stat supports the idea that just as many movers are downsizing as they are upsizing

Capitalizing on Single-Family Home Moves

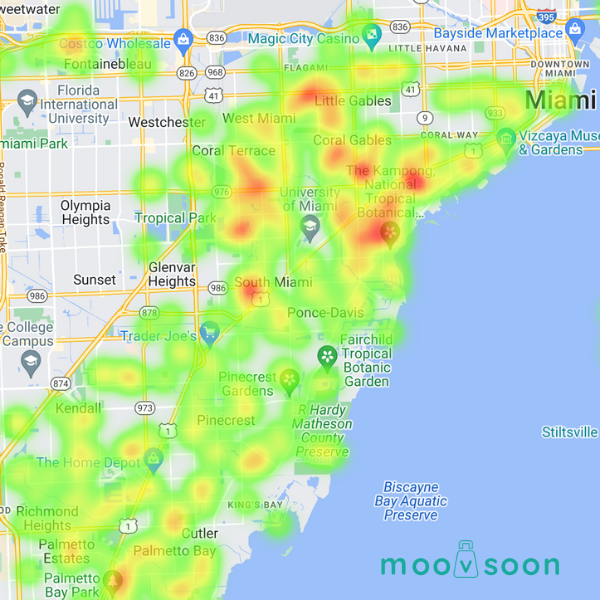

Using Moovsoon’s heatmap data, you can see heavy activity in three (randomly) pulled metro areas in more expensive, “close to downtown” neighborhoods. This supports the idea that activity occurs in higher-cost-of-living areas, even in desirable metro markets (from a moving POV). People are moving out.

We always encourage our users to review the high-activity areas in their markets. Where you see new or pending listings in communities, you should adjust marketing and sales efforts accordingly.

It’s no longer enough for a mover to wait for potential movers to find you or to “spray and pray” with your marketing effort.

The traditional moving industry has done a poor job of leveraging data. Each company has access to real estate data and its own CRM data, but movers rarely use this data to dictate strategy.

For Moovsoon, we aim to find every data point to help movers with their business. If you need any data or want to provide feedback on our “Making Moves” reports, contact us at info@moovson.com.